After the global epidemic, supply chain tension policy adjustments other factors, in 2023, the power field from the "battery shortage" to the "order shortage"; energy storage field orders, although maintaining a high growth rate, but the price cut; materials equipment, due to the Power energy storage other downstream dem market is less than expected, orders have also been sharply reduced, opening a new round of industry reshuffle.

Battery Expansion Rises Falls

In 2023, according to battery network statistics, the expansion of production in battery-related fields still occupies a large part of the industrial chain action. Among them, the 138 projects included in the statistics announced a total investment of about 694.106 billion yuan.

However, it is worth mentioning that in 2022, the total investment announced by 89 projects included in the statistics of battery network is about 905.457 billion yuan.

Among them, tens of billions of dollars of projects in 2023 is a significant reduction, from 78 in 2022 down to 29, a drop of 80%.

Battery expansion tide rise fall, behind the structural overcapacity or the main reason.

Back in 2022, the battery new energy industry chain is in a big dem, big expansion, big boom period, the capacity of the amount of battery industry chain enterprises, is conducive to locking the order, in advance of the market share, provide leverage for price negotiations.

However, under the swarming capacity expansion, structural surplus ensued, 2023 clearing de-stocking took its place as the main voice of the development of the power battery industry.

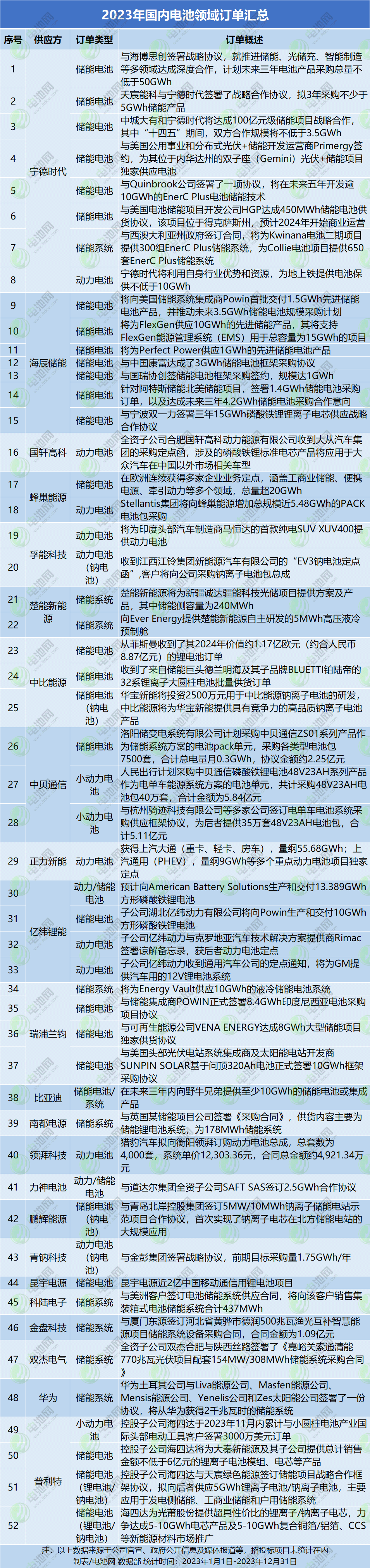

Batteries: Power goes to storage, energy storage drops in price

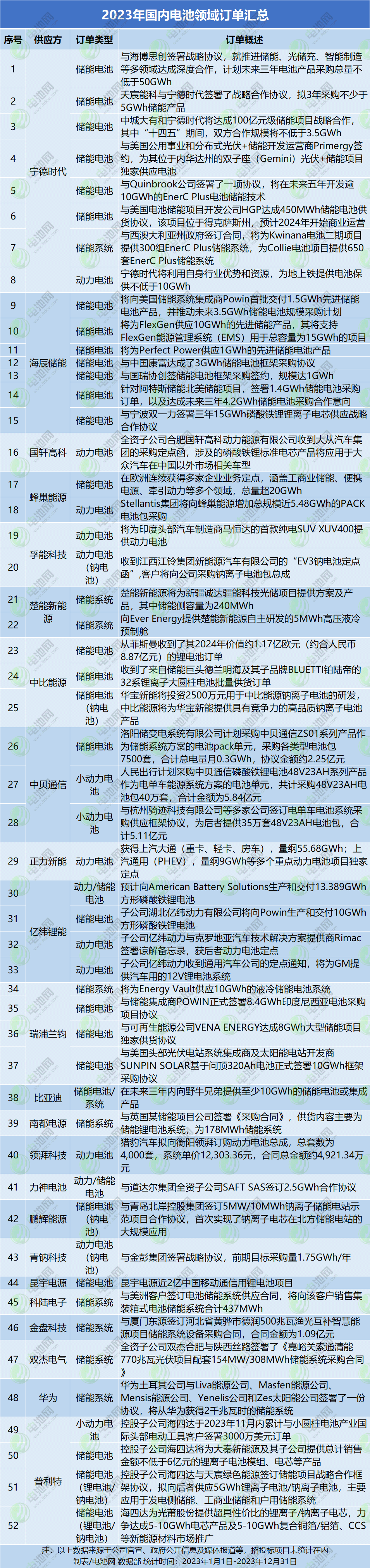

Battery network statistics, including 52 orders in the field of batteries, power batteries (including two-wheeled electric vehicles other small power batteries) in the field of 13 orders, power energy storage orders 2, energy storage batteries systems in the field of as many as 37 orders.

From the order dimension, the order in 2023 is generally cold, even if some segments of the order is still available, the profit is shrinking.

From a longer time dimension, a set of data shared by Wu Hui, General Manager of the Research Department of Ivey Economics Research Institute President of China Battery Industry Research Institute, shows that: as of the end of June 2023, the actual production capacity of the 46 global power (energy storage) battery companies included in the statistical scope of EVTank has reached 2,383.6GWh; by the end of 2026, the capacity will reach 6,730GWh, which is an increase of 18% compared with the first half of 2023, an increase of 18% compared with the first half of 2023. Compared with the actual production capacity in the first half of 2023, the growth is 182.3%.

On the dem side, from 2023 to 2026, the global dem for power (energy storage) batteries will increase from 1096.5GWh to 2614.6GWh. By 2026, the growth rate of dem is still lower than the growth rate of production capacity expansion, with a surplus of 4115.4GWh, the nominal capacity utilization rate of the whole industry will drop from 46.0% in 2023 to 38.8% in 2026.

From an analytical point of view, the power battery field order dem has plummeted, overcapacity, has been transformed from the first two years of the "battery shortage" to 2023 "to inventory".

Energy Storage Battery Field

Energy storage battery field has also opened the de-stocking mode. 2023, power battery industry large-scale de-stocking is spread from the beginning of the year to the present, the energy storage market from the end of the third quarter began to de-stock.

In addition, in 2023, the energy storage industry, although the order quantity to achieve double growth, but the price also appeared to cut.

According to CCTV financial reports, as of the end of the third quarter of 2023, China's new energy storage new installations increased by more than 920% year-on-year, the entire market bidding volume doubled compared to 2022, however, the price fell by half.

In November 2023, Wang Yanqing, chairman of Pilot Intelligence, also said publicly that "the current set price of energy storage battery cells is between 0.3 yuan/Wh 0.5 yuan/Wh, the energy storage system has fallen to 1 yuan/Wh, this price has touched the bottom line of a great part of the energy storage battery enterprises".

In December 2023, the winning cidates of 2024 annual battery core framework bidding of CECC Energy Storage Technology (Wuhan) Co., Ltd. were announced, bid package 1 for 0.5C 0.25C square aluminum lithium iron phosphate batteries, with the lowest bidding unit price of RMB 0.409/Wh the highest of RMB 0.508/Wh; bid package 2 for 1C square aluminum lithium iron phosphate batteries, with the lowest bidding unit price of RMB 0.420/Wh. Wh, the highest 0.608 yuan / Wh.

"From the beginning of 2023 to the third quarter of 2023, the entire battery industry's de-inventorying is still not strong enough, the proportion of inventory reduction is relatively small. Inventory to be reduced to a reasonable level, may not have a better inventory level until the second half of 2024 ." Wu Hui, general manager of the research department of Ivey Economic Research Institute president of China Battery Industry Research Institute, believes.

In 2023, although the battery new energy market from the high tide of expansion to the fierce competition of the "war of survival", but the wind of multi-dimensional innovation is also upward growth for the industry to gather strength empowerment.

Under the involution, in 2024, the battery new energy related industry chain enterprise survival road, enterprise technology innovation, quality products, after-sales service seems to be crucial.