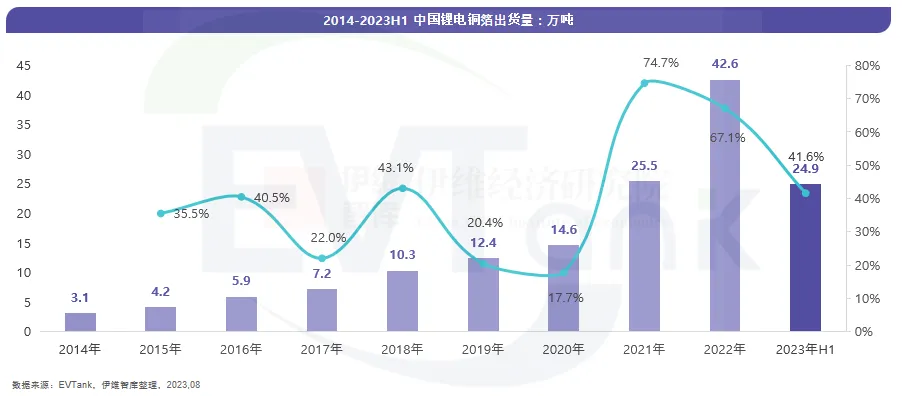

In the first half of 2023, the share of shipments of ultra-thin copper foils smaller than 6μm has reached 8.5%, the main products are 4.5μm Li-ion copper foils, EVTank pointed out that leading copper foil companies are developing validating 3.5μm Li-ion copper foils with downstream battery factories. In terms of the current shipment structure of lithium copper foil, 6μm copper foil is still the main product, while the application ratio of lithium copper foil above 6μm is further compressed.

02 In terms of the competitive lscape

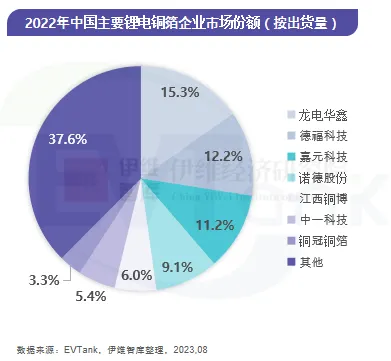

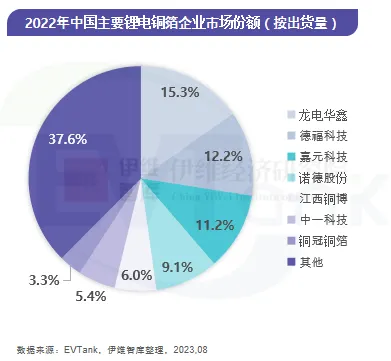

Longdian Huaxin ranked first with 65,000 tons of shipments in 2022, followed by Telford Technology, Jiayuan Technology Nordic, respectively, with the combined share of the four companies reaching 47.8%.

02

According to EVTank's data, the competitive pattern of the lithium copper foil industry is not stable, although Longdian Huaxin has been the industry leader in recent years, but the ranking of the industry's top few companies basically changes every year. in the first half of 2023, Huaxin's overall shipments surpassed those of Copper Crown Copper Foil, Zhongyi Science Technology, Jiangxi Copper Bo, Novo Nordisk, ranked the industry's fourth place.

EVTank pointed out in the whitepaper that in 2023, with a large number of new lithium copper foil production capacity coming into operation, the whole industry has shown a state of overcapacity, superimposed on the downstream lithium battery market shipments are less than expected, the processing fee of the whole lithium copper foil has dropped significantly, a large number of lithium copper foil's profitability has declined significantly or even suffered a loss.EVTank pointed out in the whitepaper that in the mass production of compound copper foil, the production of copper foil is approaching. In the white paper, EVTank points out that the competitive environment of the lithium copper foil industry will become more complicated against the background of the approaching mass production of composite copper foil.