Ningde Times, BYD, Zhongchuang New Aviation, Yi Wei Lithium Energy, Guoxun High-tech, Hive Energy, LG Energy, Panasonic, Samsung SDI, SK base statistics:

It is predicted that by 2025, the planned production capacity of the world's major power lithium battery manufacturers will reach 4335GWh, the compound growth rate of 2022-2025 will be 35%.

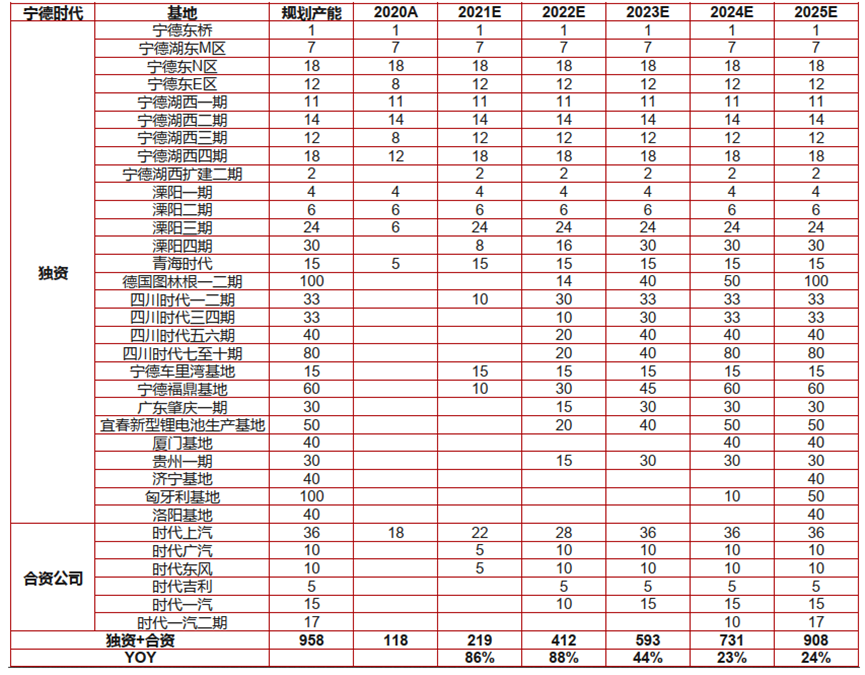

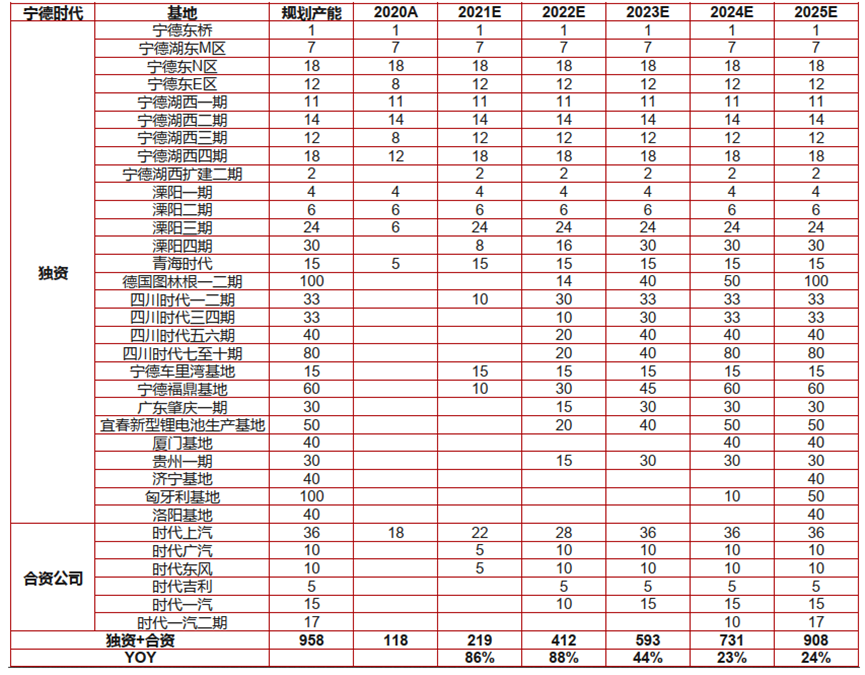

NO.1- Ningde Era: It is expected that the planned production capacity in 2025 is 908GWh, the compound growth rate is 30% from 2022 to 2025

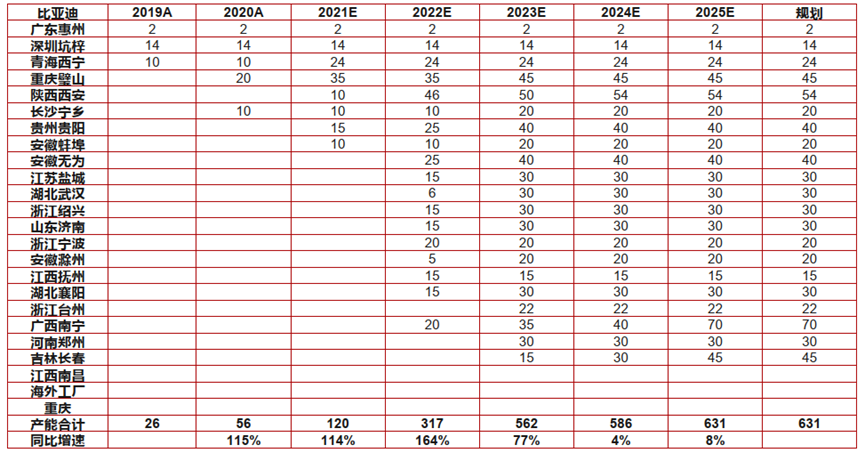

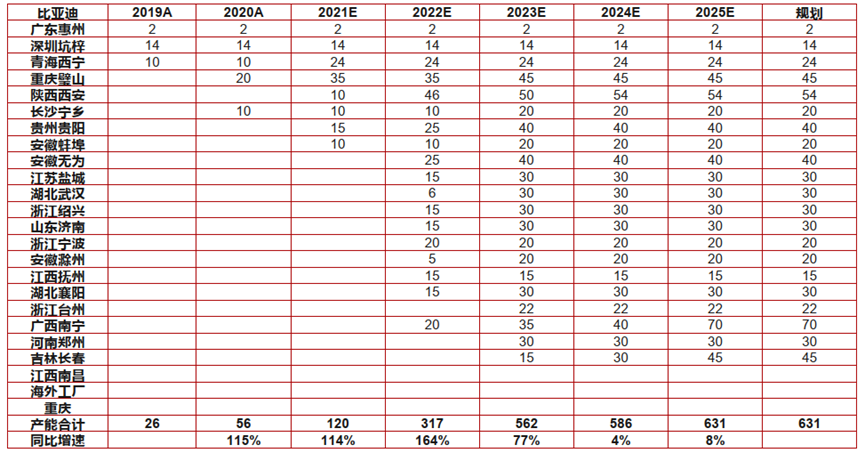

NO.2- BYD: The planned production capacity in 2025 is 631GWh, the compound growth rate is 26% from 2022 to 2025

Byd currently has nine production bases in Xi 'an, Shanghai, Beijing, Shangluo, Huizhou, Shaoguan, Changsha, Ningbo Shenzhen.

According to BYD's medium long-term capacity planning, it is expected that the planned capacity is expected to reach 631GWh in 2025, the compound growth rate of planned capacity in 2022-2025 is 26%.

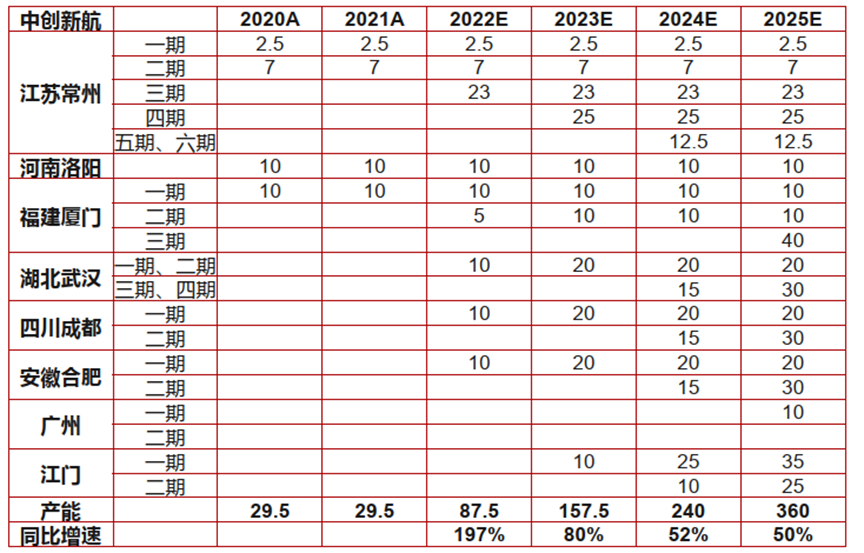

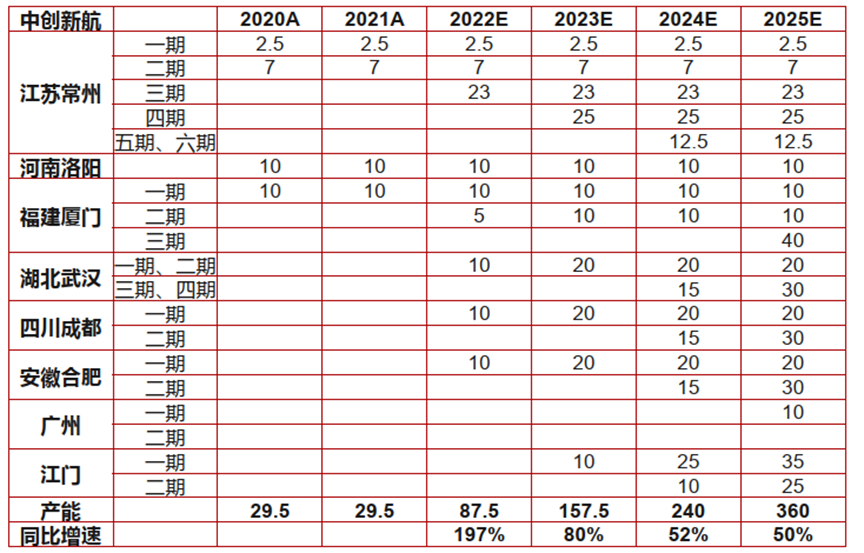

NO.3- Zhongchuang Singapore Airlines: The planned production capacity will reach 360GWh in 2025, the compound growth rate will reach 60% in 2022-2025

Founded in 2007, AVIC Lithium Battery is a high-tech enterprise specializing in the research, production, sales market application development of lithium-ion power batteries, battery management systems, energy storage batteries related integrated products lithium battery materials.

According to public information statistics, it is expected that the planned production capacity of AVIC lithium battery in 2025 will be expected to reach 360GWh (long-term planning capacity 400GWh), the compound growth rate of planned production capacity in 2022-2025 will reach 60%.

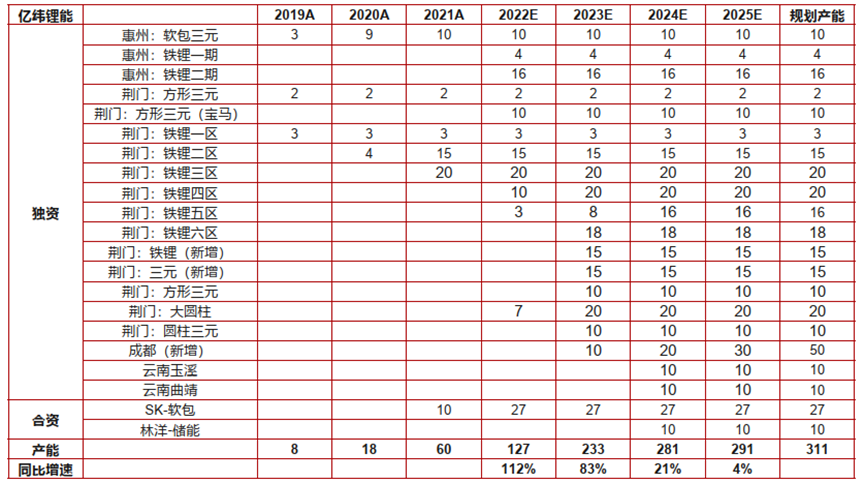

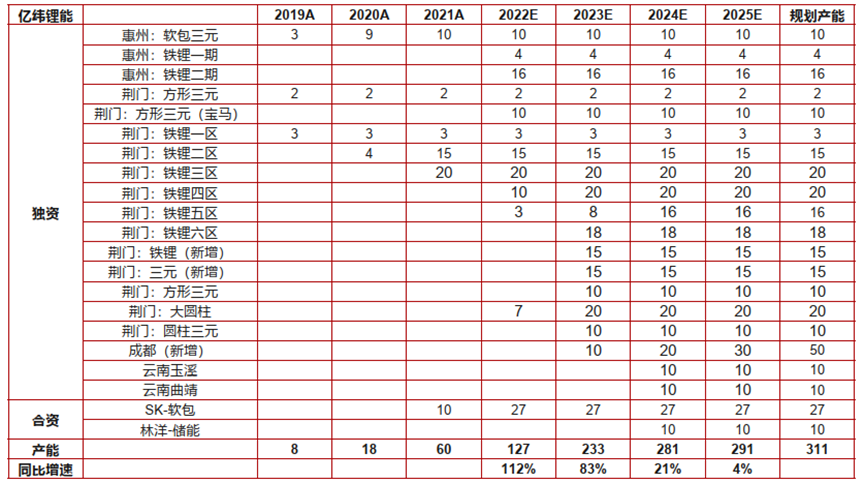

NO.4- Yiwei Lithium Energy: The planned production capacity of 291GWh in 2025, the compound growth rate of 32% from 2022 to 2025以上翻译结果来自有道神经网络翻译(YNMT)· 通用场景

Yiwei Lithium Energy was founded in 2001, listed in Shenzhen GEM in 2009, after 20 years of rapid development, has become a globally competitive high-quality lithium battery platform company, at the same time with consumer battery power battery core technology comprehensive solutions, products are widely used in the Internet of things, energy Internet field.

According to public information, we predict that the company's planned production capacity in 2025 will reach 291GWh, the compound growth rate of annual production capacity from 2022 to 2025 will reach 32%.

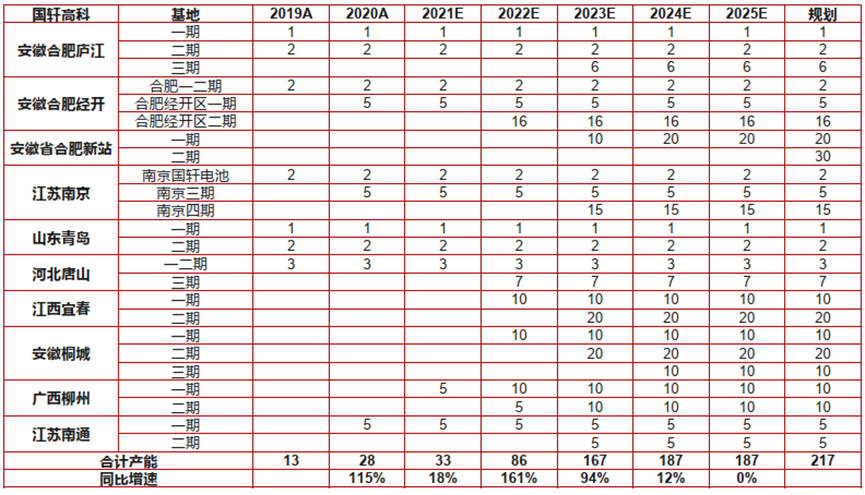

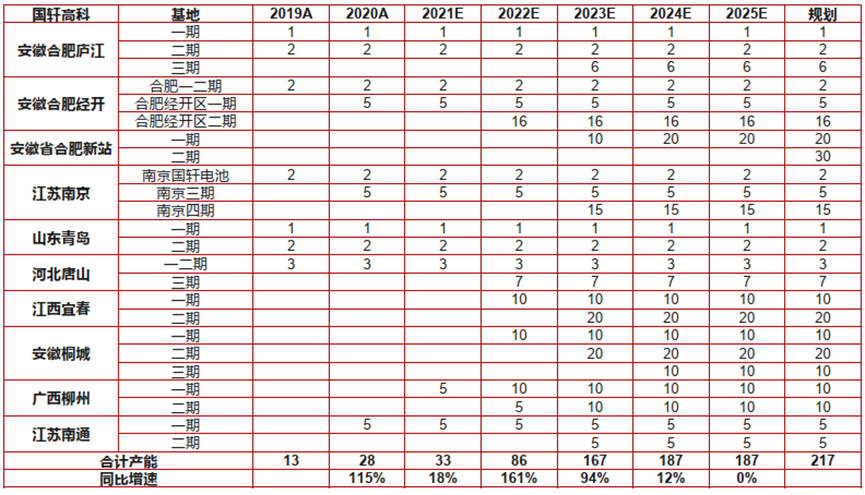

NO.5- Guoxuan High-tech: The planned production capacity in 2025 will reach 187GWh, the compound growth rate will reach 30% from 2022 to 2025

Founded in 2006, the company's lithium iron phosphate production line was put into operation in 2007, in 2009, it undertook the 863 program to provide power batteries for electric buses. In 2019, the company signed a procurement framework agreement with Bosch to mainly provide 48V lithium battery products.

Volkswagen became the company's largest shareholder, accounting for about 26.5% of the total share capital, the first foreign auto company to control a Chinese battery manufacturer.

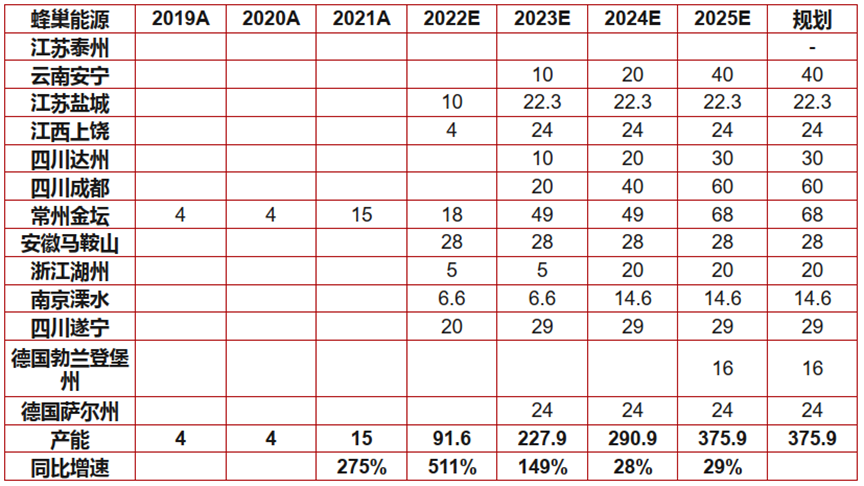

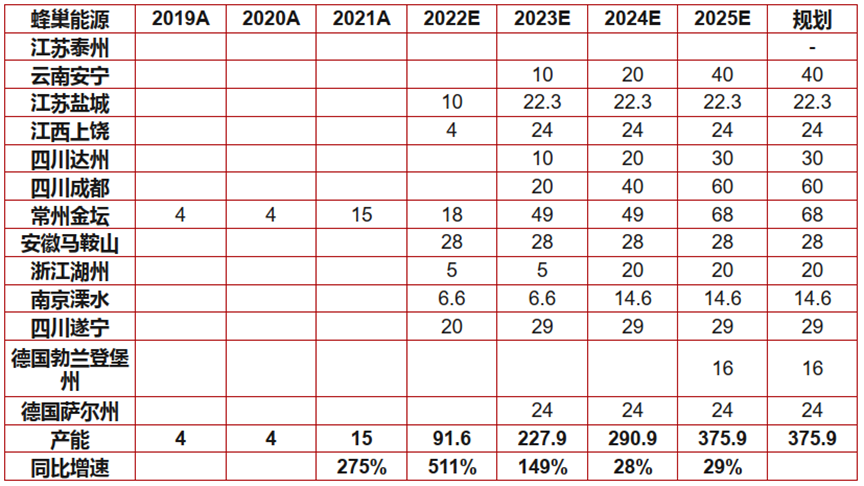

NO.6- Hive Energy: Annual production capacity of 376GWh in 2025, compound growth rate of 60% from 2022 to 2025

Hive Energy, formerly known as Great Wall Motor Power Battery Division, headquartered in Changzhou, Jiangsu Province, is committed to the development, manufacturing innovation of next-generation battery materials, cells, modules, packs, BMS energy storage technology.

It is predicted that the company's annual production capacity will reach 376GWh in 2025, the compound growth rate of annual production capacity from 2022 to 2025 will reach 60%.

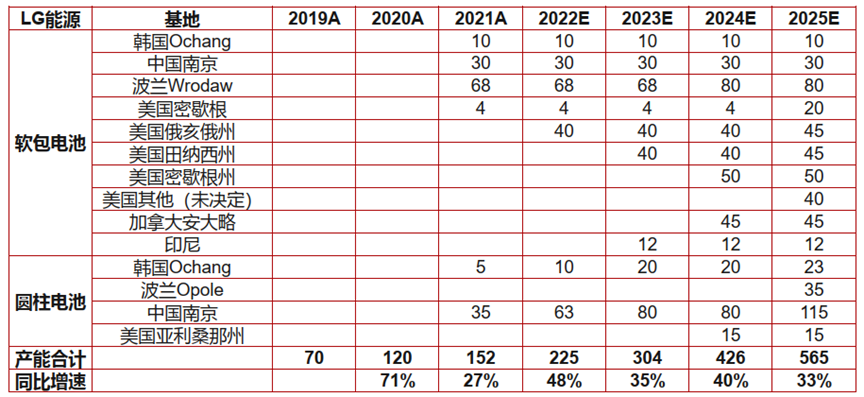

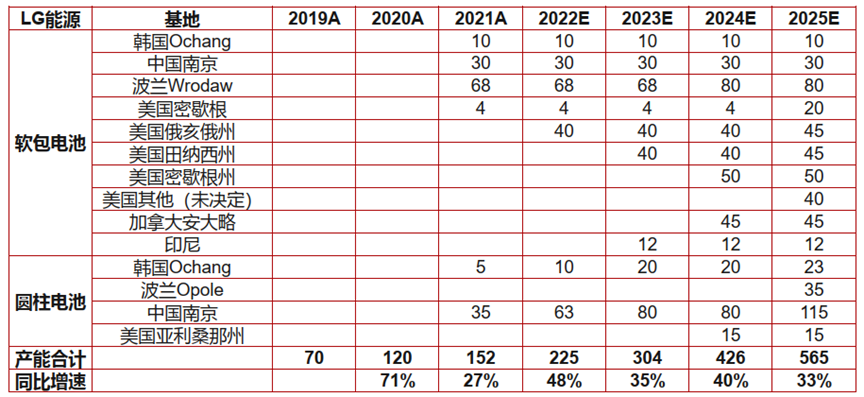

NO.7-LG Energy: Planned production capacity of 565GWh in 2025, compound growth rate of 36% from 2022 to 2025

Supporting or supporting well-known models include Chevrolet Volt, Bolt, Renault Zoe, domestic Model3 so on.

- Unlike leading overseas battery manufacturers such as Panasonic AESC, LG Energy is the only chemical materials-based battery company (rather than a consumer electronics company), decades of dedicated research have helped it accumulate rich technology process experience in chemistry materials science.

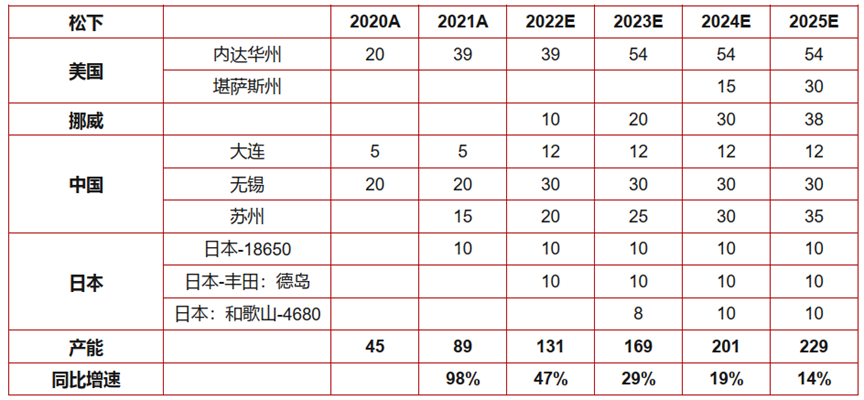

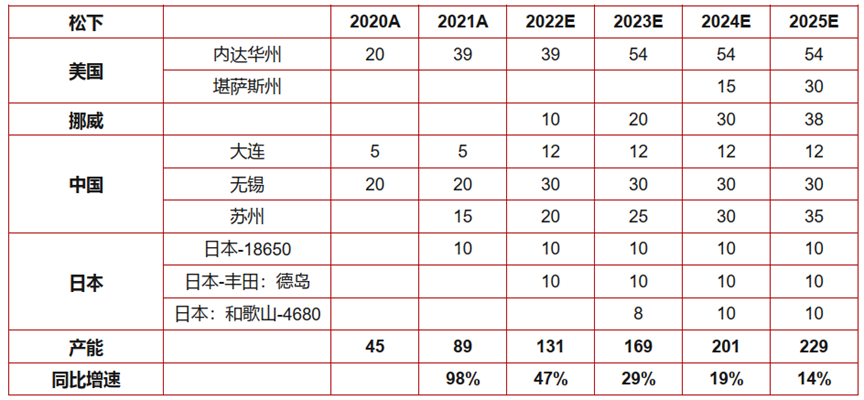

NO.8- Panasonic: Planned production capacity of 229GWh in 2025, 2022-2025 compound growth rate of 20%

In 2008, it entered the field of power batteries through the acquisition of Sanyo Electric became an important supplier of Tesla. In order to reduce the risk of heavy dependence on a single customer, we have cooperated with Volkswagen, Toyota, Ford other car companies.

The company is a leader in cylindrical batteries, its development strategy is: not blindly pursue expansion, but adhere to the intensive development route, first make the product fine strong, then cut into the market through the advantages of technology. Panasonic is also prioritising cooperation with local companies to explore overseas markets to reduce risk.

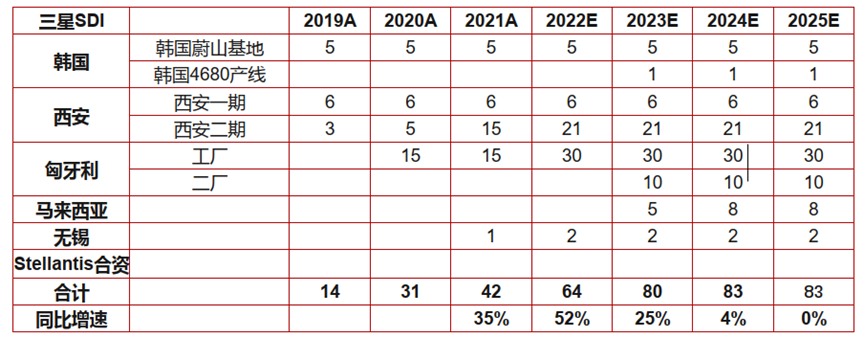

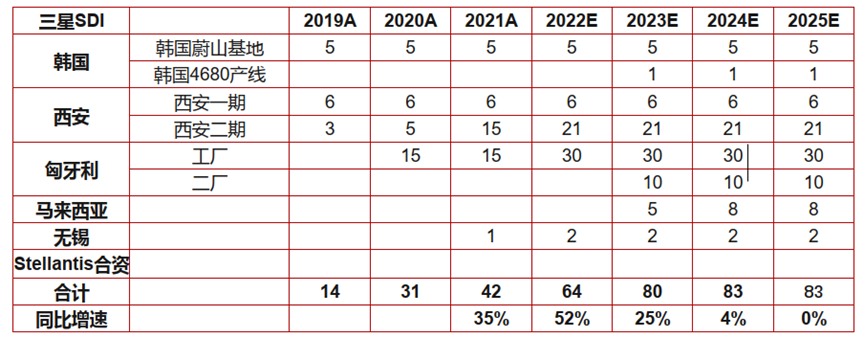

NO.9- Samsung SDI: Planned production capacity of 83GWh in 2025, compound growth rate of 9% from 2022 to 2025

SDI is a leading square battery company in South Korea belongs to the Samsung Group. In 1999, Samsung SDI began to enter the battery industry; In 2008, SDI Bosch established a joint venture power battery company SBLimotive, which officially started the power battery business. Since 2010, SDI has established production bases in Ulsan, South Korea, Xi 'an, China, the United States, Hungary other places.

Since the signing of the Memorum of Understing in 2014, SDI has provided BMW with i3EV, i8PHEV, X5, 330 other products. In addition, the company has become a supplier to Volkswagen (Porsche Cayenne, Audi e-tron), Chrysler, etc.

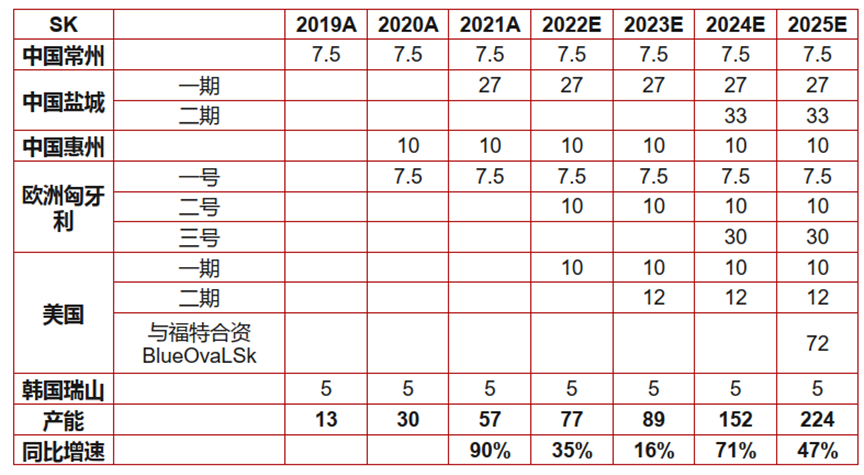

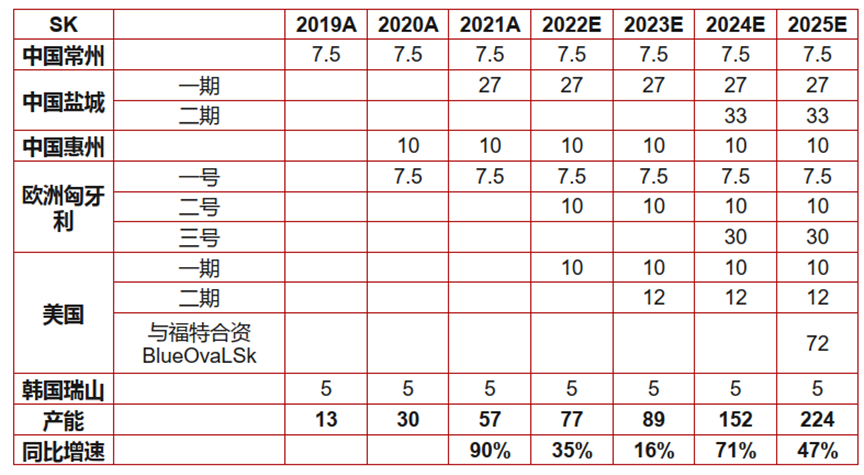

NO.10-SK: The planned production capacity in 2025 will reach 224GWh, with a compound growth rate of 43% from 2022 to 2025

SK was founded in 1962 as South Korea's first oil refining company. In 2013, SK Battery Division cooperated with BAIC Group to produce power batteries was the first Sino-foreign joint venture battery company in China.

The company is the world's first manufacturer of NCM622 811, is the world's second largest manufacturer of wet diaphragm, especially the coating technology in the market leader. SKI focuses on soft-pack batteries, with an energy density target of 284wh/kg in 2020. The company has production bases in Pol, China the United States.

Development opinion

The development of a variety of power battery technology routes, the continuous innovation optimization of lithium technology, the "removal of cobalt" "removal of nickel", the avoidance of upstream rare metals are essential to the stability of the domestic battery industry chain.

While enterprises continue to invest in the expansion of production, they also need to spend a considerable part of their energy on the iterative upgrading of technology, leading the industry to the right direction, making the road of new energy more healthy broader.