一、fourMonthly Macroeconomy

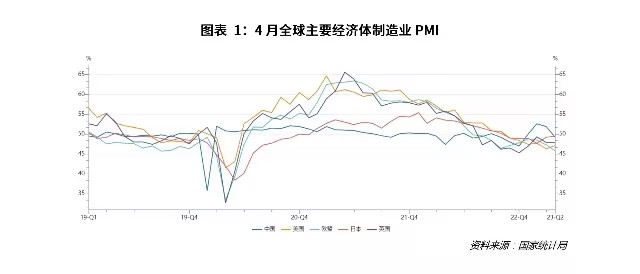

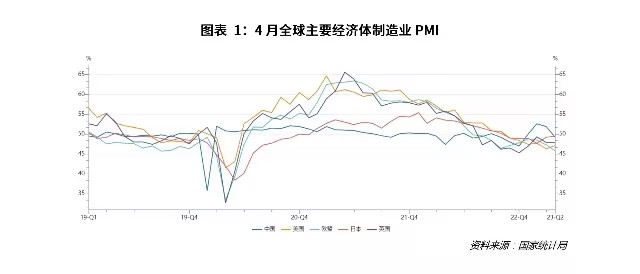

1.Global manufacturing trends, increasing uncertainty

In April, the global economic index fell, with major economies such as China, the United States, the European , Japan, etc. all below the critical point. The momentum for economic recovery still needs to be consolidated.

In summary, the overall contraction rate of the manufacturing industry is accelerating, the global economic outlook continues to be unstable.

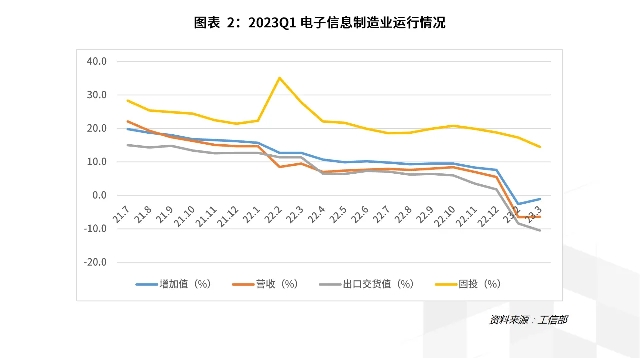

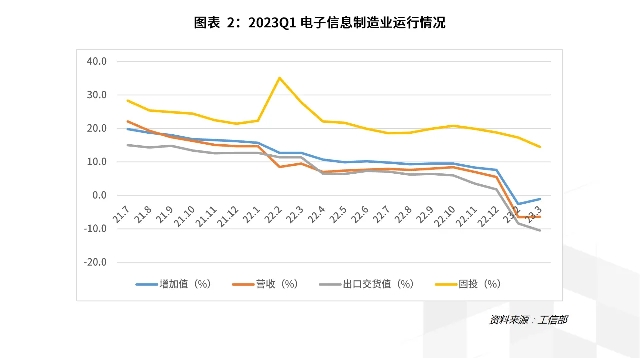

2.The electronic information manufacturing industry continues to shrink is in a downturn

In Q1 2023, the decline in electronic information manufacturing production narrowed, exports continued to decline, benefits improved, investment continued to grow.

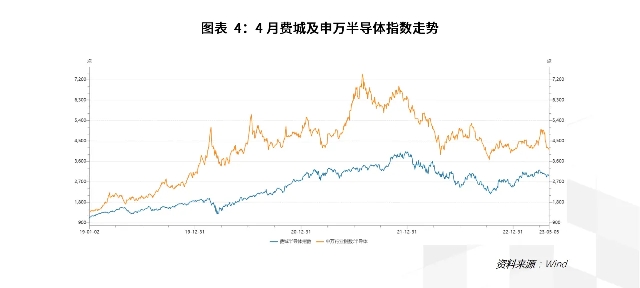

3.Semiconductor sales plummeted the index fell

In Q1 2023, global semiconductor sales reached $119.5 billion, a decrease of 8.7% month on month 21.3% year-on-year. Regionally, Chinese Mainl was the worst performing region with a year-on-year decline of 34.1%.

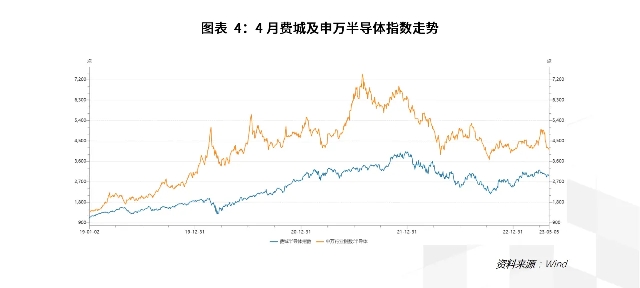

From the perspective of the capital index, the Philadelphia Semiconductor Index (SOX) fell 6.4% in April, while the China Semiconductor (SW) industry index fell by 10.0%. Affected by market dem, investor confidence has declined.

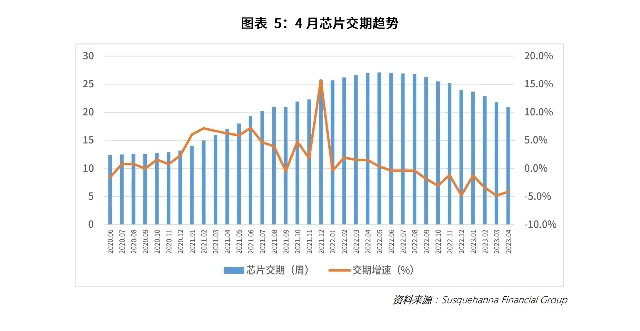

二 Trend of chip delivery time in April

1.Overall chip delivery trend

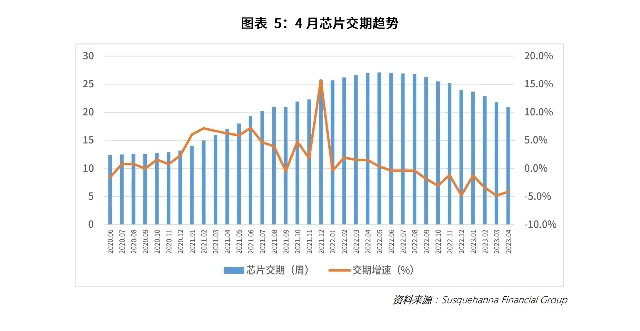

4According to the latest incomplete forecast data, the global chip delivery cycle is less than 20 weeks.

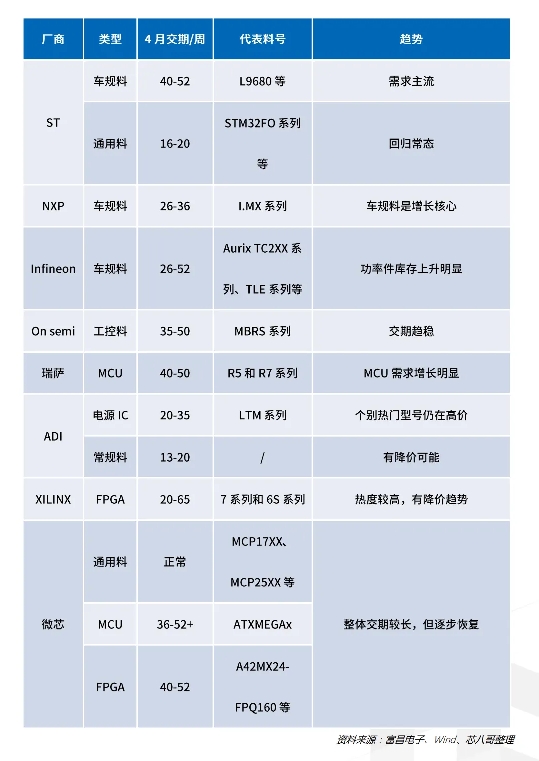

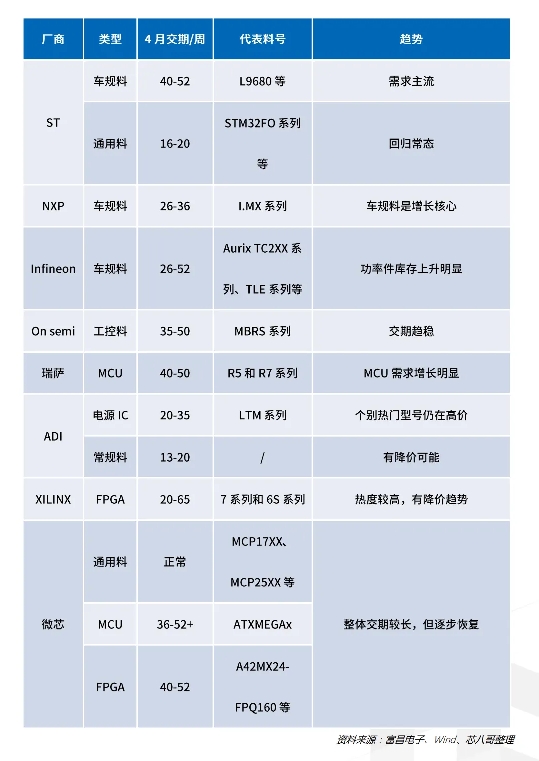

2.List of Key Chip Suppliers' Delivery Times

followAccording to the latest dynamic monitoring in April, the delivery time of general materials from top manufacturers has gradually ed to normal, vehicle specification materials are the core of growth.

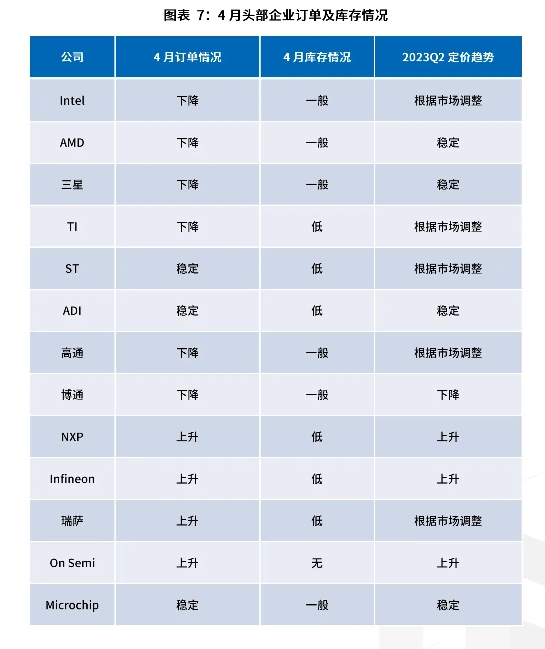

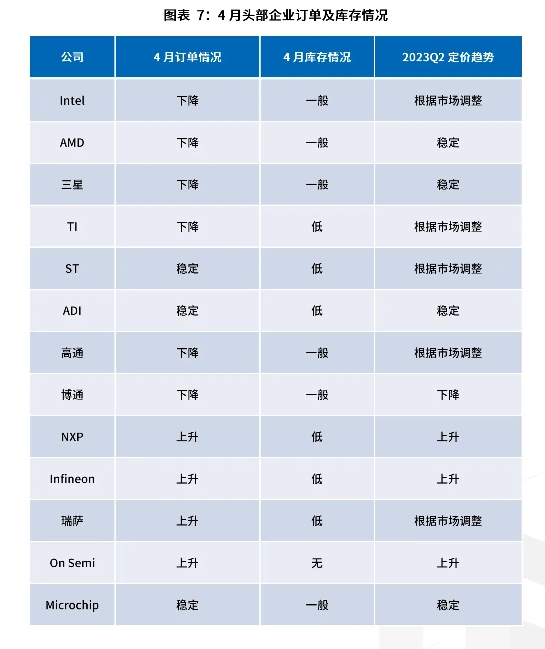

三、Order inventory situation in April

From the perspective of enterprise orders actual inventory situation, consumer manufacturers' inventory has improved, the supply prices of excavation materials have stabilized. Vehicle specification materials are the key to growth.

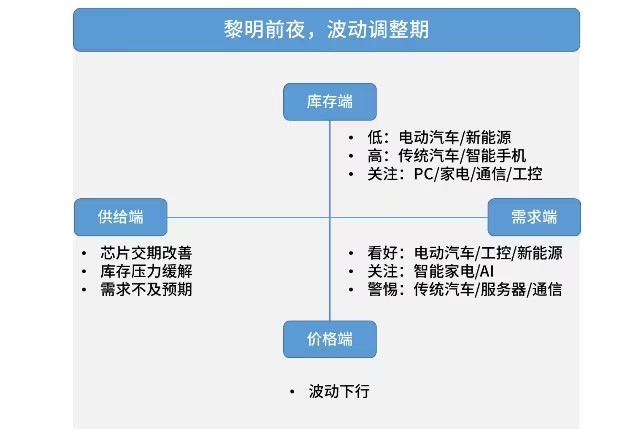

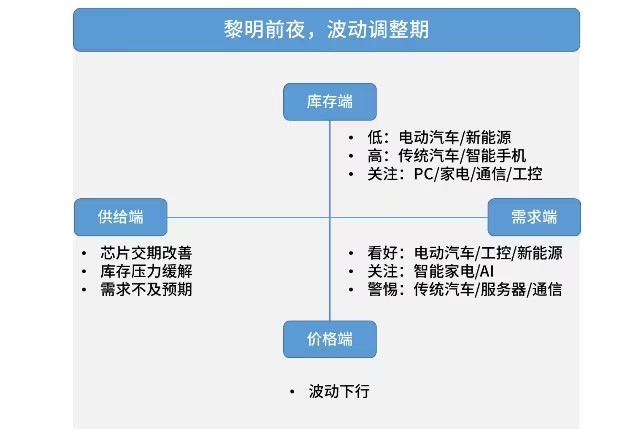

四、April Semiconductor Supply Chain

The production capacity of the supply side OEM factory has not been reduced yet, the price has not been compromised. The dem side has made a correction, but it is less than expected.

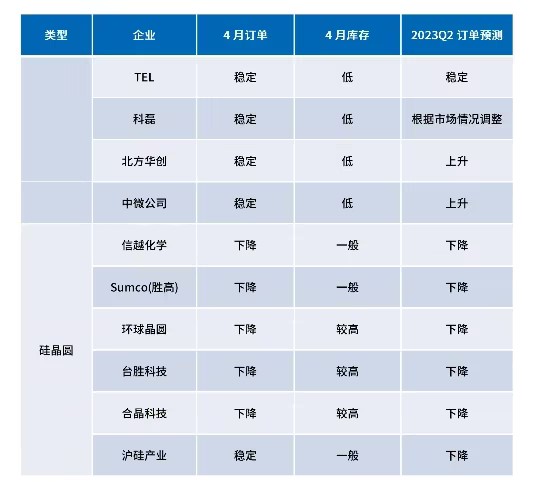

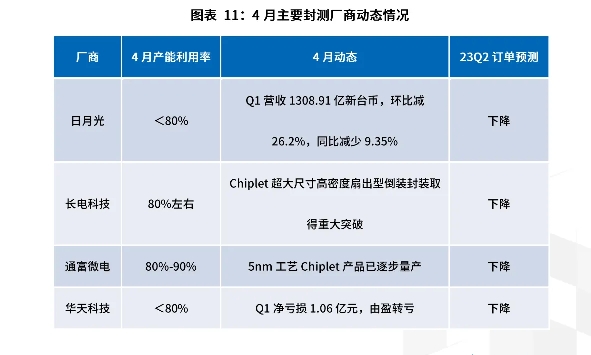

1.Semiconductor upstream manufacturers

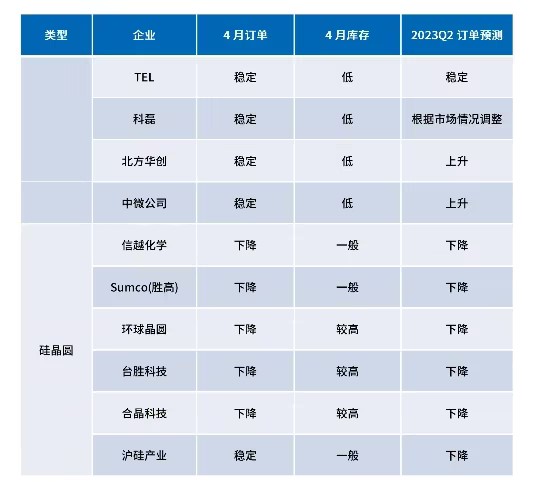

(1)Silicon wafer/equipment

In April, ASML was severely cut off, with concerns about the impact of export restrictions on Japanese overweight equipment; Affected by dem, the short-term supply of silicon wafers exceeds dem.

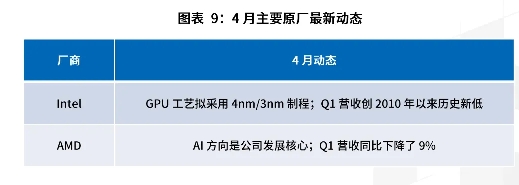

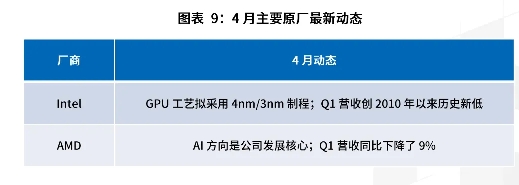

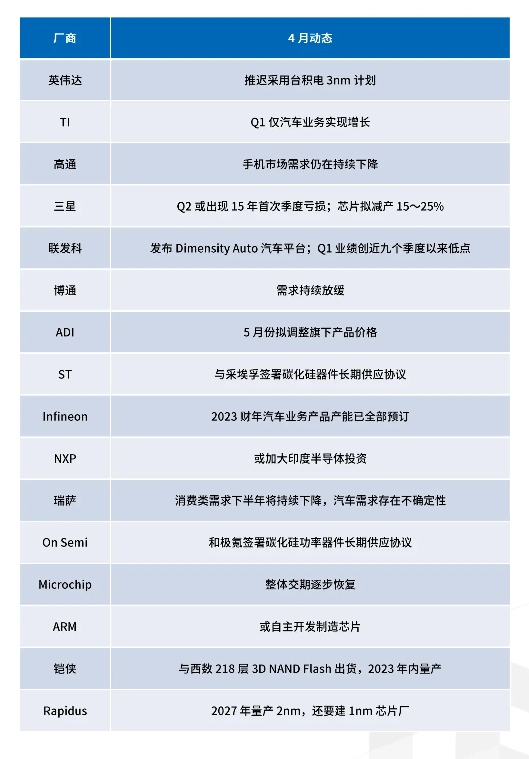

(2)Original factory

In April, the adjustment of the consumer market represented by smartphones fell short of expectations, car grade stards will become the "hope" for growth.

In Q1 2023, global semiconductor sales reached $119.5 billion, a decrease of 8.7% month on month 21.3% year-on-year. From a regional perspective, Chinese Mainl was the worst performing region with a year-on-year decline of 34.1%。

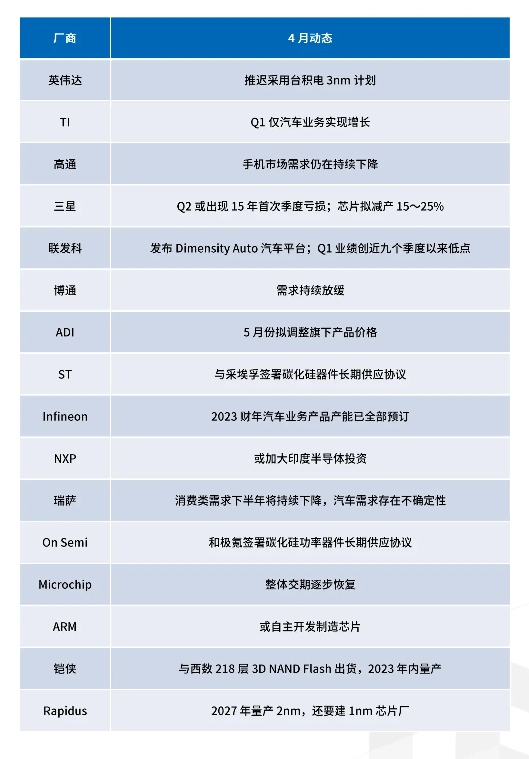

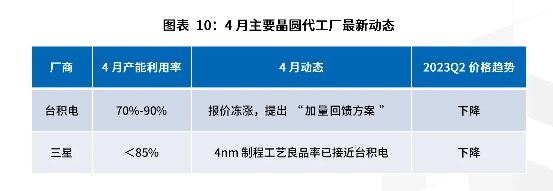

(3)Wafer foundry

In April, OEM factories led by TSMC strongly controlled production stabilized prices.

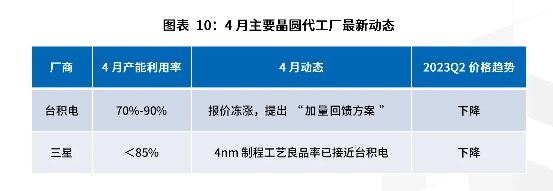

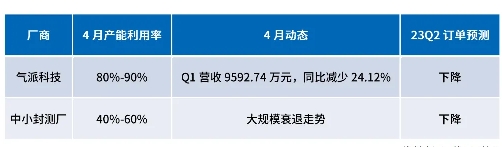

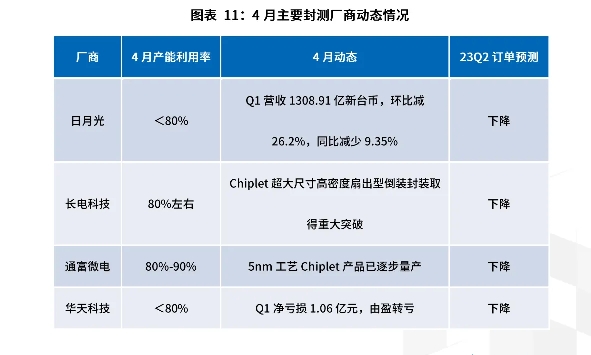

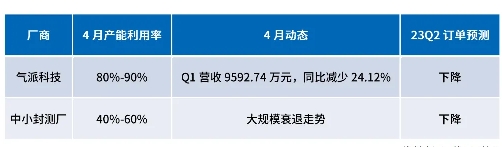

(4)Package Testing

In April, dem for advanced packaging also fell into weakness

2.distributor

In April, distributors actively laid out the supply chain of new energy vehicles