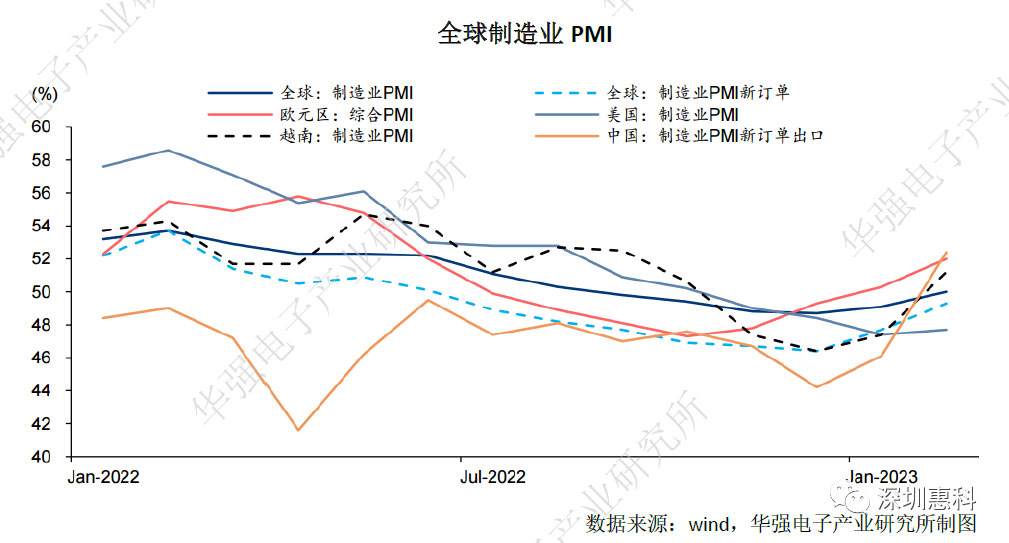

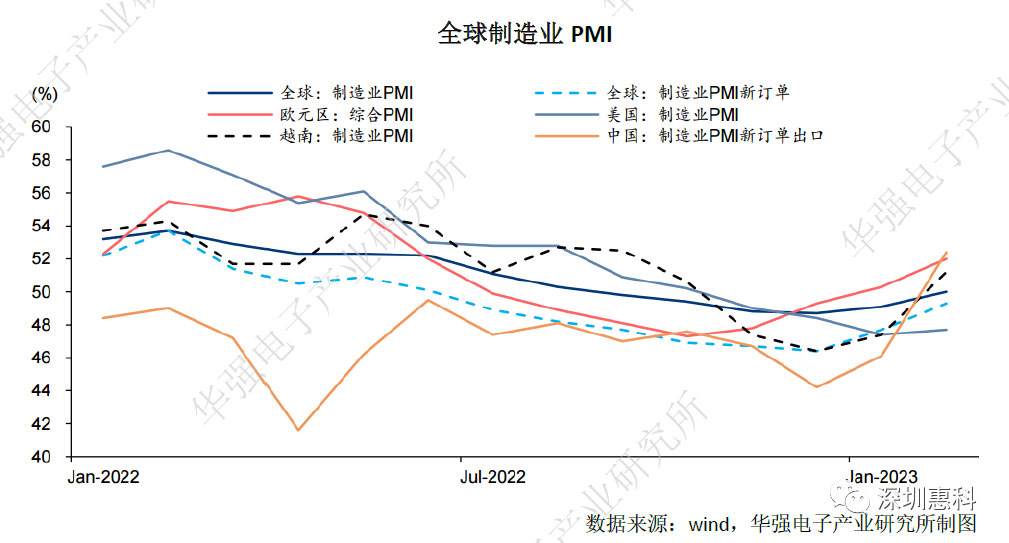

At present, the global economic environment is still full of uncertainty, the manufacturing industry as a whole is still at a historical low. The repair capability of electronic information production manufacturing in China is still weak.

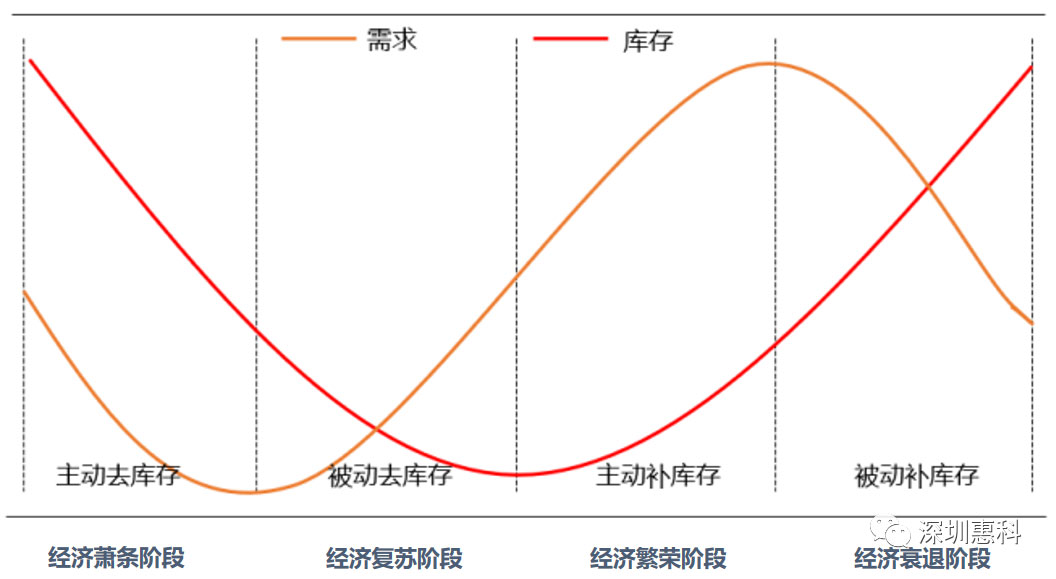

From the perspective of economic operation, it is economic dem that determines the inventory cycle. The goal of industrial enterprises is to maintain a basically stable inventory to sales ratio. When economic dem fluctuates, the inventory to sales ratio changes, which leads to a macro inventory cycle.

On a micro level, both high low inventory can cause problems for a single enterprise. Generally speaking, a high inventory level indicates poor product sales, while a low inventory level will result in the inability to complete orders on time affect sales.

So, inventory cycle is actually the behavior taken by enterprises to respond to fluctuations in economic dem.

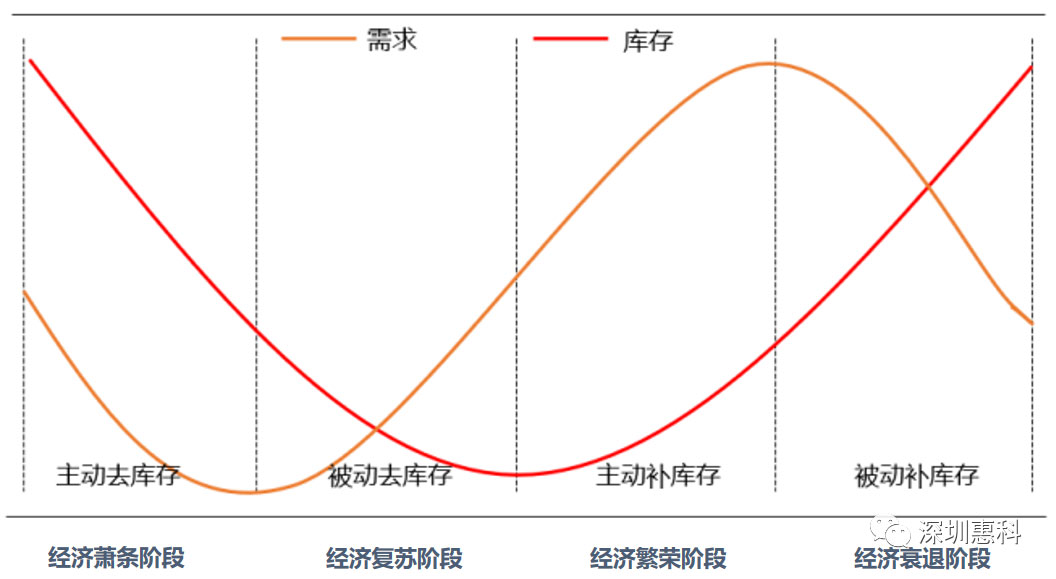

The inventory cycle depicts the four stages of the business cycle

01

The inventory cycle is often characterized by inventory levels economic dem, which can be roughly divided into four stages. Active destocking is mainly due to weak economic dem, enterprises realize the economic downturn actively reduce inventory. The passive destocking is mainly due to the recovery of economic dem, but the enterprise still has not exped production, resulting in a gradual decline in inventory as sales increase. The active replenishment of inventory is mainly due to the continuous recovery of economic dem, enterprises actively exping production, production supply exceeding economic dem, driving up inventory levels. The passive replenishment of inventory is mainly due to the decline in economic dem, which prevents enterprises from contracting production in time, the decline in sales leads to a passive increase in inventory. Generally, it takes 3-4 years to complete four stage cycles.

How to observe inventory cycle

02

Observing the inventory cycle is generally based on the inventory data of industrial enterprises' finished products, using its year-on-year changes as a judgment indicator for the cycle. A year-on-year increase in inventory indicates replenishment, while a year-on-year decrease in inventory indicates destocking.

In addition, PMI inventory indicators can also be used to determine inventory cycles. However, as a prosperity diffusion indicator, PMI's inventory breakdown is equivalent to a month on month ratio fluctuates frequently in the short term. However, its trend is completely consistent with that of finished product inventory, which can become an auxiliary indicator for directional judgment.

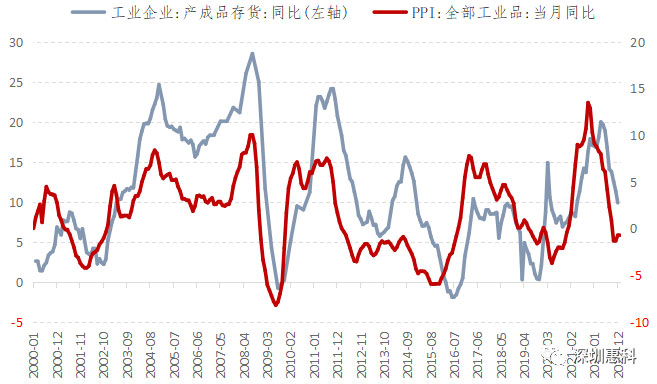

PPI has a good lead in inventory cycle

03

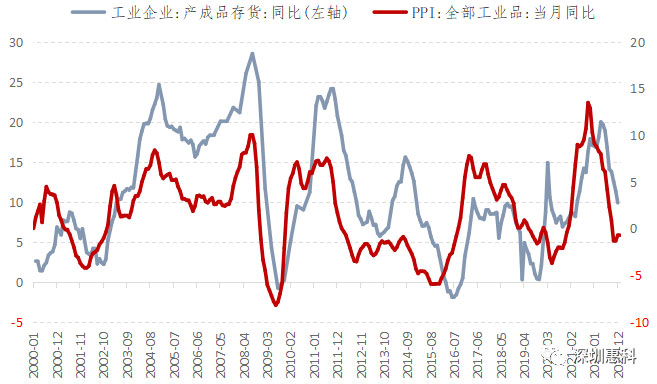

From the correlation between inventory cycle PPI, PPI has a strong leading relationship with inventory cycle. Basically, the inflection points of PPI can lead the inflection points of industrial inventory, the trend of PPI is relatively consistent with the trend of inventory cycle, indicating a strong indication of inventory cycle.

However, in 2019, due to the impact of the COVID-19 on the supply side, the degree of PPI recovery was far lower than the recovery of the inventory level, which led to the periodic replenishment de stocking behavior in this round of inventory cycle, the indicator of PPI declined. However, in the subsequent inventory cycle, PPI still remained a good leader.

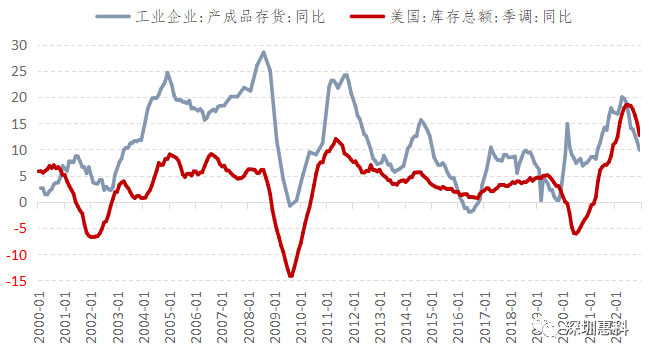

The inventory cycle between China the United States is once again synchronized, ing to the destocking stage

04

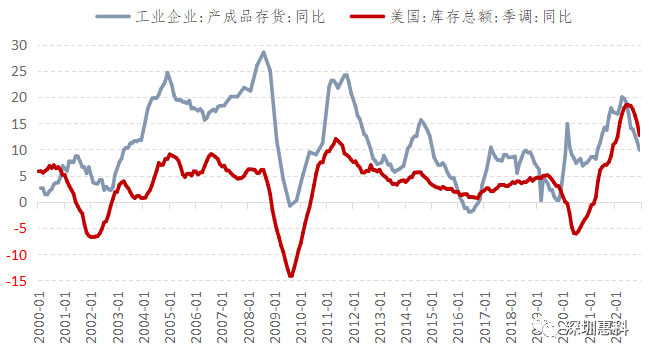

Prior to this inventory cycle, the inventory cycles between China the United States often had strong synchronicity in history. In previous rounds of inventory, the inventory cycle of the United States will slightly lead the domestic inventory cycle, especially after the 2008 financial crisis, the correlation between the inventory cycle of China the United States will be further strengthened.

But in the recent two rounds of inventory cycles, there has been a certain degree of differentiation in the inventory cycles between China the United States.

In the sixth inventory cycle launched in 2016, after China's inventory cycle rapidly rose to its peak, it began a slow destocking cycle, with inventory growth maintaining a slow downward trend. However, the inventory cycle in the United States experienced a long upward cycle, with a difference of about a year between its high point the high point of the domestic inventory cycle. The main reason for this is that the domestic inventory cycle is driven by investment, with both real estate infrastructure driving force, Driving the inventory cycle to rapidly rise, while the United States mainly relies on consumption to drive, the upward trend is relatively moderate.

After the outbreak of the COVID-19 in 2020, this round of inventory cycle in the United States experienced a longer replenishment cycle, the overall level of inventory continued to rise, the inventory peak level was significantly higher than in the past 20 years. Due to the impact of the epidemic, the domestic inventory cycle has experienced repeated replenishment cycles, resulting in a significant extension of replenishment time in this cycle, the high level of this week's inventory cycle is also relatively average. The main reason for the difference in the inventory cycle between China the United States this round is the different focus of the epidemic in China the United States. Domestic efforts are more focused on repairing production supply, while the United States is using fiscal stimulus to restore household dem, which leads to the differentiation of the inventory cycle. At present, the Sino US cycle has started to synchronize again, both in the destocking cycle.

Terminal inventory dem score析

05

The mobile phone market is weak, terminal manufacturers are still in the stage of destocking. It is expected that the market will resume growth by 2024

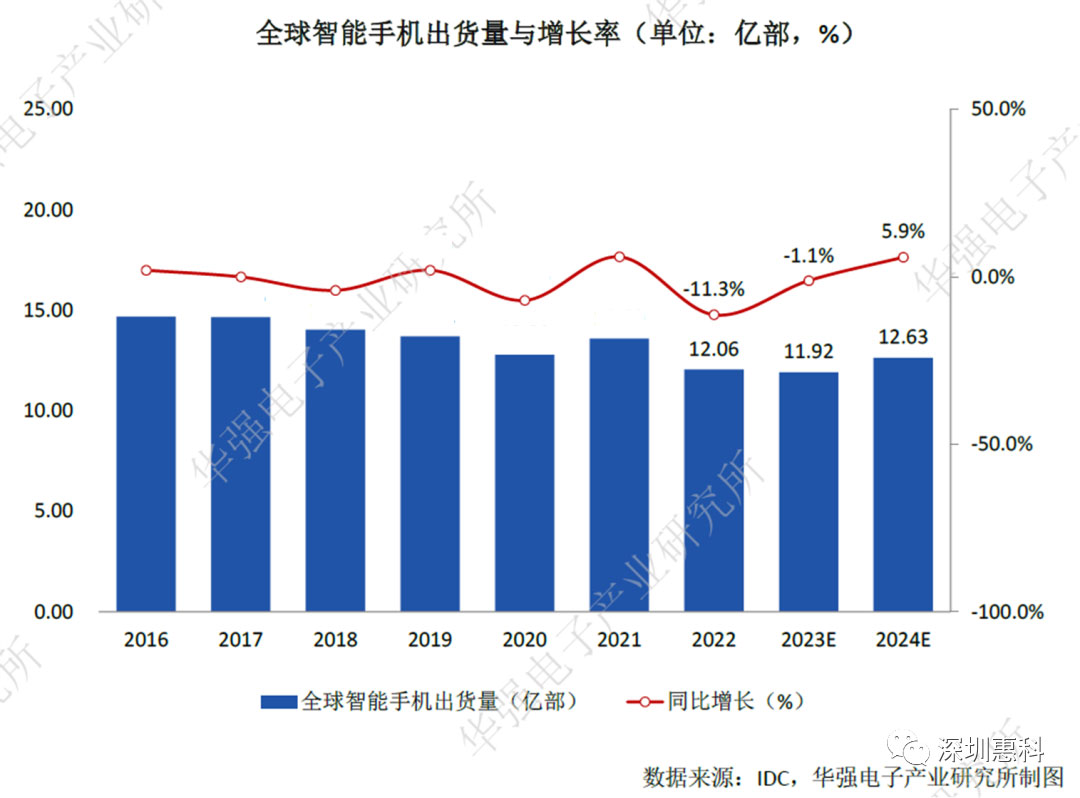

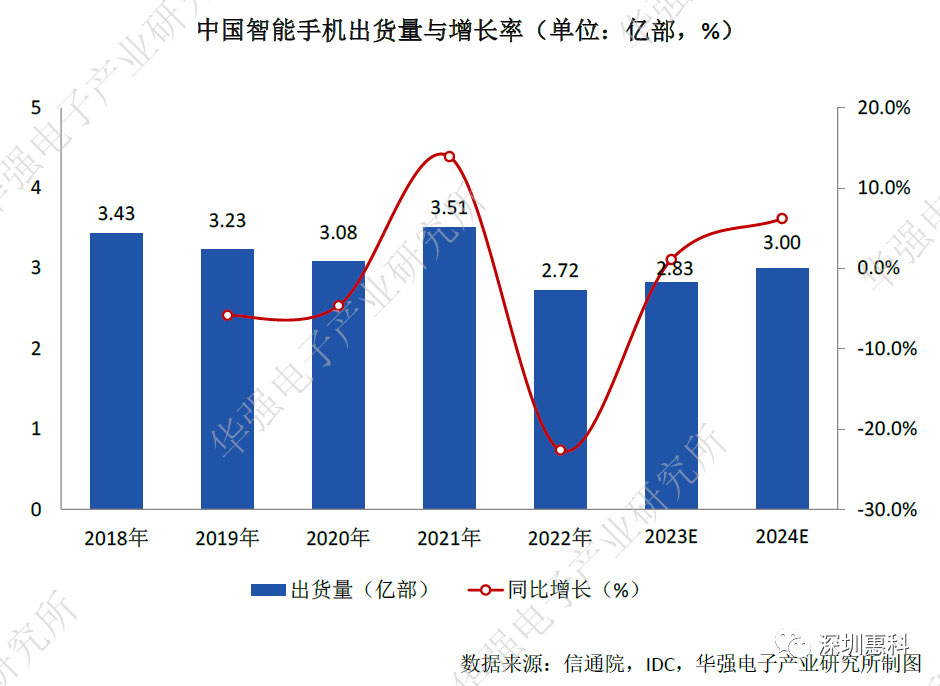

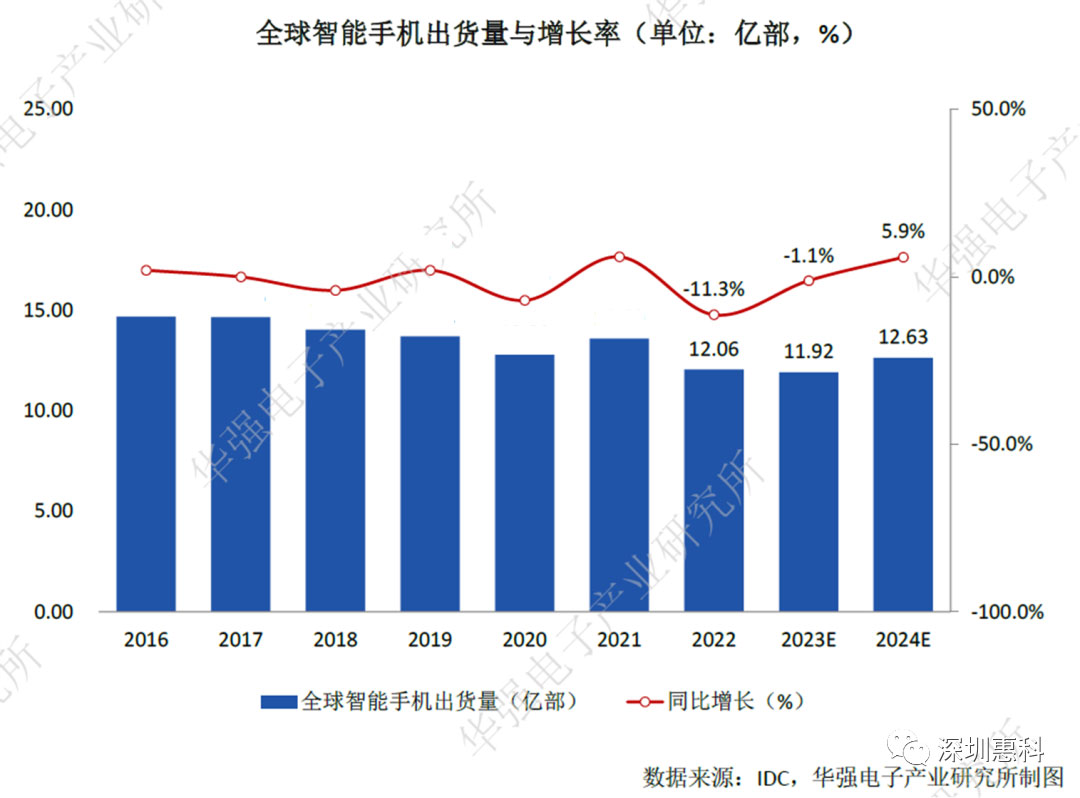

Inflation economic uncertainty have severely suppressed consumer spending, coupled with a weakened marginal innovation in mobile phones severe product homogenization. The smartphone industry has entered the stage of stock replacement, market dem is limited. According to IDC data, due to a slower than expected market recovery, IDC has recently revised its forecast predicts that smartphone shipments will decrease by 1.1% to 1.19 billion units in 2023. IDC believes that the smartphone market is not expected to experience a real recovery until 2024, when it is expected to grow by 5.9% year-on-year.

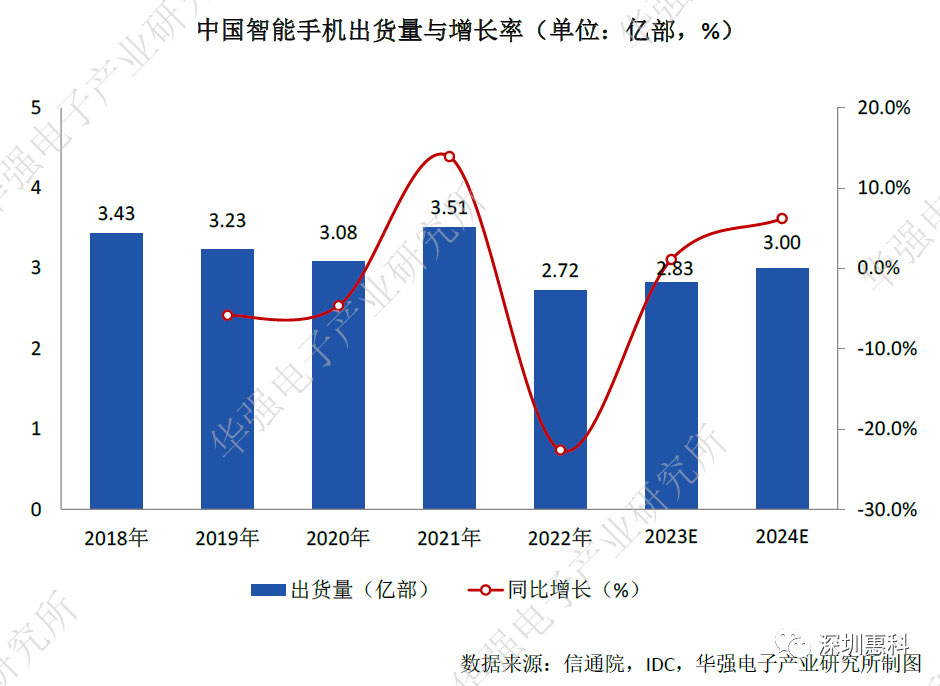

The domestic market trend is not optimistic either. According to statistics from the China Academy of Information Communications Technology, the overall shipment volume of mobile phones in the domestic market in 2022 has accumulated 272 million units, a year-on-year decrease of 22.6%, a significant decrease in market consumer dem. In terms of inventory, after the de inventory process in 2022, preliminary results have been achieved, the turnover days of channel end inventory showed a significant decline in the third quarter of 2022. According to the outlook of Intel, TSMC, SMIC, the 1H2023 consumer electronics industry will continue to be in the process of destocking, the smartphone industry is expected to complete the destocking process by the second half of the year. Looking ahead to the Chinese smartphone market, with the gradual improvement of the economic environment, there will be a certain rebound in the Chinese smartphone market, which will continue until next year. IDC predicts that by 2024, the shipment volume of the Chinese smartphone market is expected to to the 300 million market, with a year-on-year growth of 6.2%.

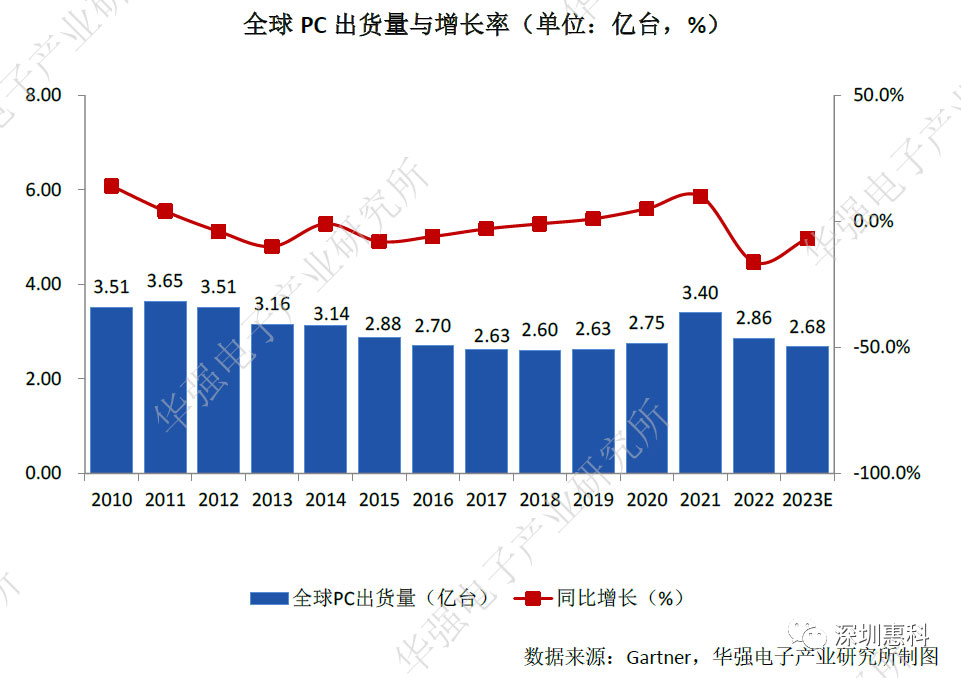

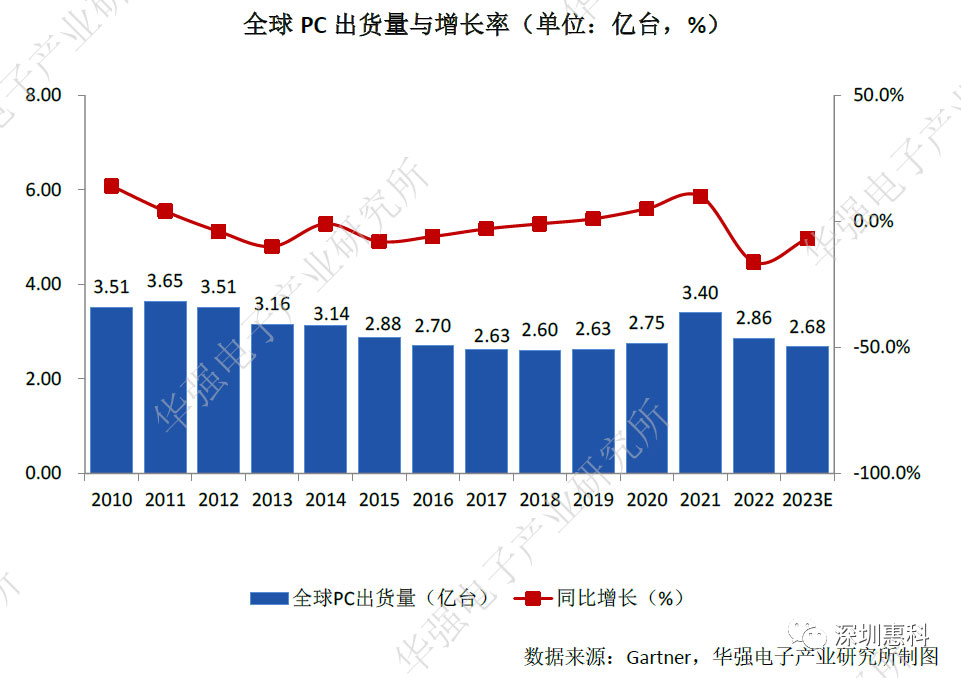

PC sales have suffered a setback, it is expected that the shipment volume in 2023 will continue to shrink. The PC market is also affected,

According to Gartner data, the global PC shipment volume in 2022 was 286.2 million units, a year-on-year decrease of 16.2%. Due to the slowdown in consumer dem, the basic satisfaction of education dem, the deterioration of macroeconomic conditions, corporate dem has been compressed. It is expected that global PC shipments will continue to contract further in 2023, with a decrease of 6.8%.

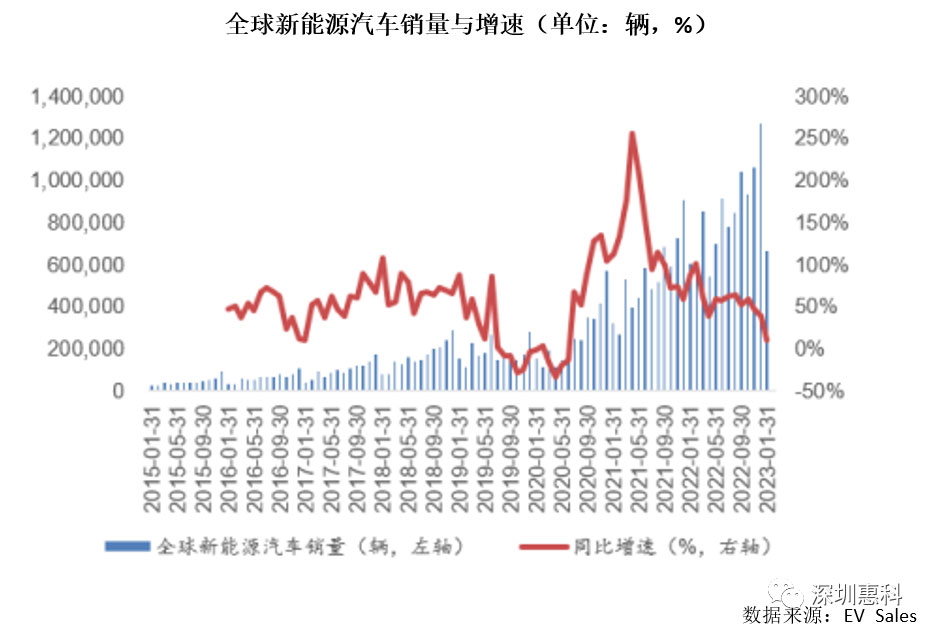

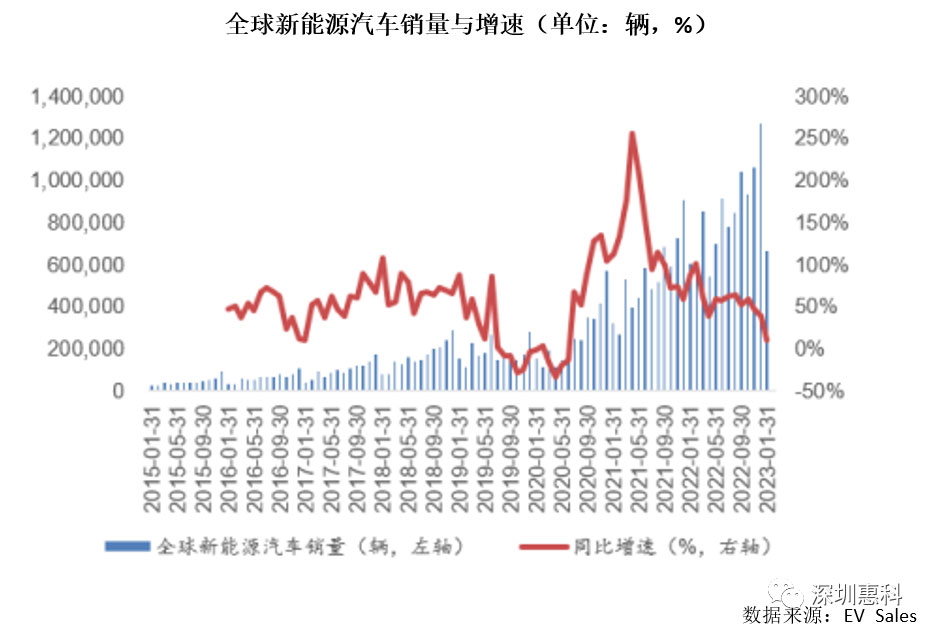

The overall automotive market is showing a stable positive trend, sales are expected to continue to maintain high-speed growth in 2023. According to EV Sales data, global new energy vehicle sales in 2022 were 10.07 million units, a year-on-year increase of 56.37%; In January 2023, the global sales of new energy vehicles reached 660000 units, a year-on-year increase of 9.85%.

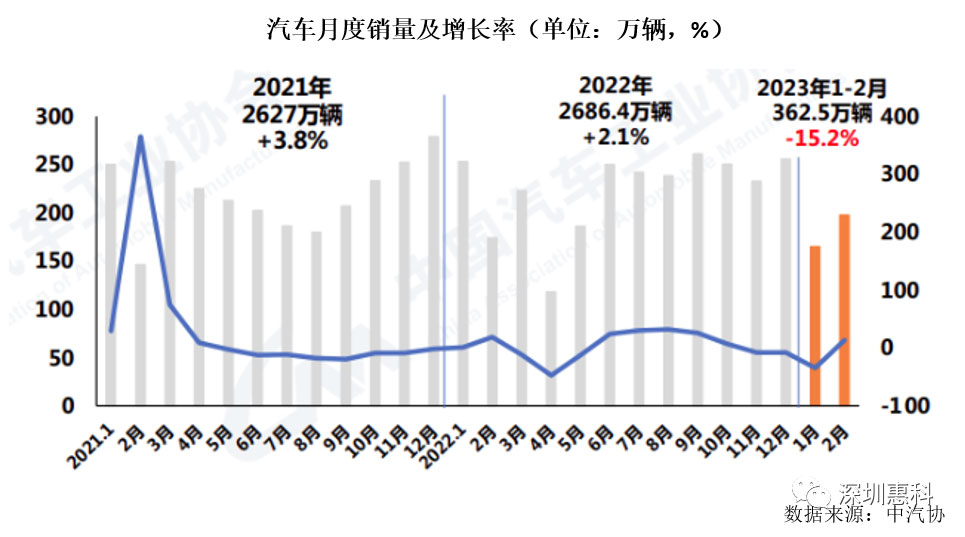

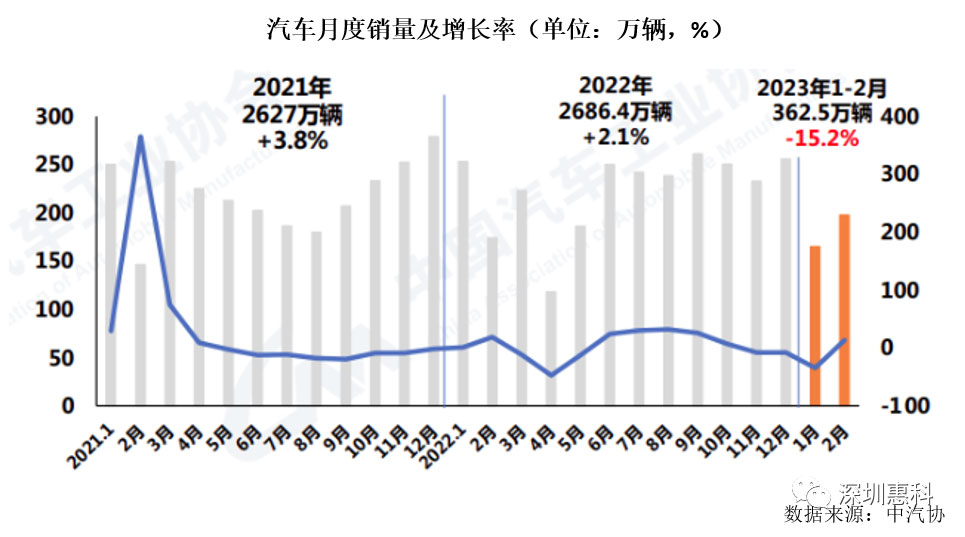

In the Chinese market, due to the preferential purchase tax for fuel vehicles the withdrawal of national subsidies for new energy vehicles at the end of 2022, some dem has been overdrawn ahead of schedule. Coupled with the current off-season in the traditional car market weak terminal dem, overall car sales have declined in the first two months of this year. According to data from China Automobile Association, the production sales of automobiles from January to February this year were 3.626 million 3.625 million, respectively, a year-on-year decrease of 14.5% 15.2%. Among them, the production sales of new energy vehicles have accumulated 977000 933000 units, with year-on-year growth of 18.1% 20.8% respectively, a market share of 25.7%.

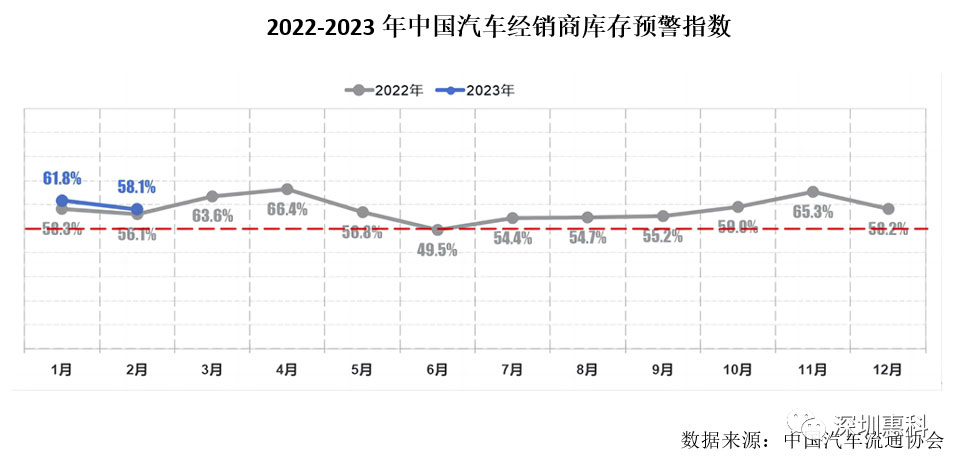

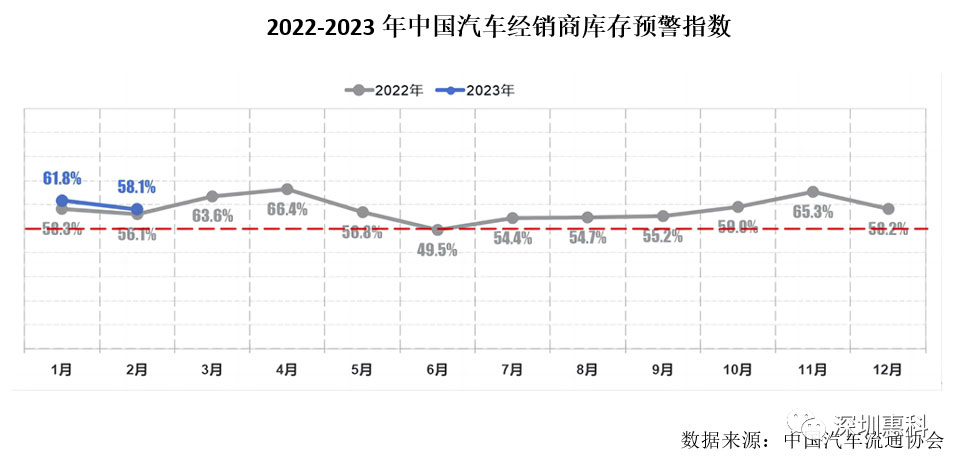

In terms of inventory, the inventory warning index of Chinese automobile dealers in February 2023 was 58.1%, an increase of 2.0 percentage points year-on-year a decrease of 3.7 percentage points month on month. The inventory warning index is above the boom bust line, the pressure on dealers remains unchanged.

Currently, subsidies are being issued in multiple regions to boost car consumption, many car companies are launching large-scale price reduction activities to stimulate car sales. In the short term, the price reduction trend is expected to boost Q2 car sales. Throughout the year, the China Automobile Association predicts that the overall automotive market will show a stable positive development trend in 2023, with a potential growth rate of 3% for the entire year.

小结

From a cyclical perspective, in the first half of 2023, destocking remains the main theme of the semiconductor industry, the expectation of a cycle bottoming out recovery is gradually becoming clear. From the perspective of downstream dem, the structural differentiation characteristics are still evident. Consumer electronics dem, represented by mobile phones, PCs, others, remains weak. IDC believes that the smartphone market is not expected to experience a real recovery until 2024. The consumer electronics market has declined, but there are still bright spots in the semiconductor industry chain, with automotive electronics being the most dazzling market among them. The overall automotive market is showing a stable positive trend, it is expected that sales will continue to maintain high-speed growth in 2023. In addition, driven by a dual carbon economy, the photovoltaic energy storage field will continue to improve. Looking ahead to the second half of 2023 2024, as the global economy recovers, dem for downstream consumer electronics markets such as smartphones, smart appliances, smart cars recovers, chip inventory continues to decrease, prices tend to stabilize. As dem side growth drives the gradual release of supply side production capacity, the mismatch between supply dem may catalyze price increases. It is expected that the semiconductor industry will reverse from its trough in 2023 enter an upward cycle in 2024.